What gives with Greece? If we look at only one, narrow, set of the statistics, i.e. government debt and official GDP figures, and compare them with other nations, then by all means Greece is essentially bankrupt - just as so many fear-mongering "analysts" claim.

But... Disraeli's saying "lies, damned lies and statistics" is always a good piece of advice. Even if he actually never said it himself.

So what should we look at? Two facts:

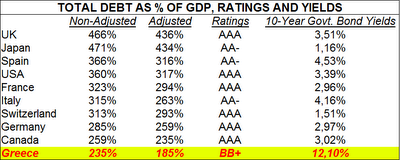

- Greece has one of the lowest total debt to GDP ratios amongst OECD nations. Yes, that's right, lowest; because even though government debt is very high at 127% of GDP (end of 2009 and going higher, probably to 140% by the end of 2012) private debt (i.e. corporate plus household) comes to only 108% of GDP, making for a total debt to GDP ratio of only 235%. That's lower than Switzerland (313%), Canada (259%) or, gasp!, ever-so-self-righteous Germany itself (285%).

- Greece has a very large, but very real, "shadow" economy due to widespread tax-evasion and corruption. The IMF estimates it at 27% of GDP, by far the highest of any OECD nation (average is estimated at 11%). This means that officially reported Greek debt/GDP ratios are grossly overstated.

Below is a table I constructed based on data from McKinsey for total debt (2009) and the IMF for the shadow economy. The adjusted figures include the shadow economy in the total debt to GDP ratio.

See anything grossly out of line?

One has to wonder how "the market" operates sometimes, eh? Looks like Greece got run over by a reindeer this Christmas. On purpose..?

Sem comentários:

Enviar um comentário